The government has announced an extension to JobKeeper beyond the initial 28 September conclusion. This extension means it is available to all eligible businesses (including the self-employed) until March 28 2021.

However, JobKeeper is not simply carrying on in its current form. Businesses who have been claiming JobKeeper subsidy may not continue to be eligible. New businesses who were not previously eligible may become eligible in the September quarter and be able to apply for the extended JobKeeper period.

Keep in mind that due to the ongoing pandemic, changes may continue to be made up to, and even beyond the time, that the new JobKeeper payments kick in.

Here’s an overview of the changes that have been announced:

Qualification Criteria

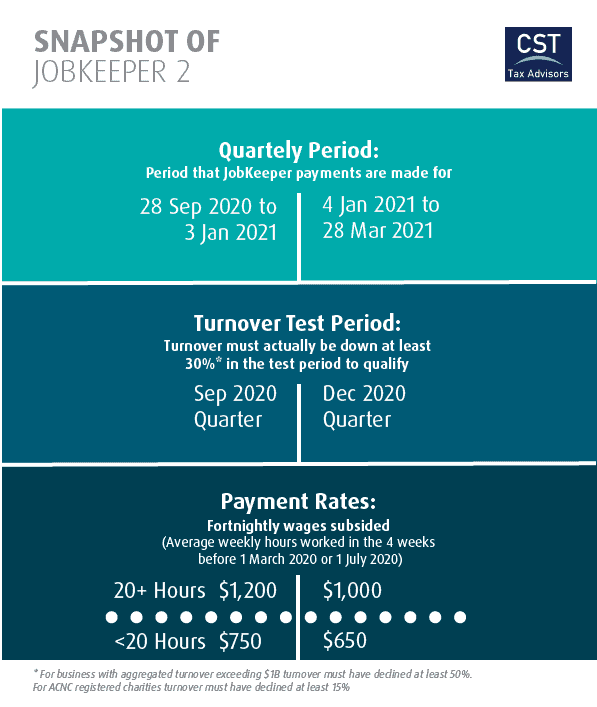

To receive JobKeeper payments after 28 September the business will have to show that their actual turnover has experienced a significant decline for the September 2020 quarter. This differs to the original requirement of simply having to have a reasonable expectation of decline.

This means that a qualifying business must actually have a turnover that, in their September 2020 quarter, is at least 30% less than the turnover they had in their September 2019 quarter.

Businesses with an aggregate annual turnover of more than $1 billion must actually have a turnover for their September 2020 quarter that is at least 50% less than their September 2019 quarter.

To continue to claim the JobKeeper payments for the March 2021 quarter, the business will have to confirm the ongoing impact of loss of income in the December 2020 quarter. This means they must actually have the lower income in the December 2020 quarter when compared to their December 2019 quarter, in order to continue to claim JobKeeper in the March 2021 quarter.

Businesses who were not previously claiming JobKeeper, but who are eligible in the September 2020 quarter based on their actual turnover, and meet all the other original qualifying tests, may apply as new recipients.

As occurred with the original JobKeeper payments, the Commissioner will have the discretion to set alternative tests, where comparing the actual turnover to the equivalent period in the prior year, is not appropriate.

Eligible Employees

Employees that will be included in the extended JobKeeper subsidy must meet the following criteria:

- Currently employed by the employer (including being stood down or re-hired).

- Were a full-time, part-time, of fixed-term employee at 1 July 2020 OR

- Were a long-term casual who was employed for over 12 months on a regular basis, and is not employed as a permanent employee elsewhere.

- Over 18 years of age on 1 July 2020 (or an independent 16 or 17 year old who was not studying full-time).

- Australian resident (as defined in the Social Security Act 1991) or

- New Zealand citizen living in Australia under the Special Category Subclass 444 visa (which is the Visa that automatically applies to New Zealand citizens who come into Australia).

- Were not being paid parental leave or Dad and Partner pay under the Paid Parental Leave Act 2010.

- Were not being paid under a worker’s compensation payment due to a total incapacity to work.

An individual who has multiple jobs can only claim JobKeeper from one employer. They cannot elect to claim JobKeeper in a position where they have been a regular casual for more than 12 months, if they are eligible for JobKeeper with another employer for whom they are permanently employed.

Self-employed individuals will be eligible to continue to receive JobKeeper as long as they meet the original requirements and the relevant turnover test, and are not permanently employed by another employer.

Payment Amount

December Quarter:

Under the extended JobKeeper payments, the fortnightly payment will be reduced from $1,500 to $1,200. This is for any employee who was employed for at least 20 hours or more a week.

For employees who worked less than 20 hours a week, payments will be reduced to $750. Business participants who worked less than 20 hours a week will also be paid at these lower rates.

March Quarter:

For the March 2021 quarter the JobKeeper payments drop to $1,000 a fortnight for all eligible employees who worked for at least 20 hours a week.

Employees who worked less than 20 hours a week will be paid out at $650 a fortnight.

The working hours used to determine whether an employee worked more or less than 20 hours a week are the 4 weeks prior to 1 March 2020. However, this test period may not always be relevant since the extension now includes permanent employees who were employed as of 1 July 2020, and casuals who meet the 12 month employment criteria by 1 July 2020.

A business may apply for the Commissioner’s discretion for alternative tests where an employee or business participant’s usual working hours were different in the qualifying period than they would normally have been (for example if they were on voluntary leave during the bushfires, or not employed in the previous quarter).

Further Information About JobKeeper

Like the original JobKeeper program, JobKeeper is a wage subsidy that is paid to eligible employers in order to help cover the cost of wages that they are paying to their employees.

The JobKeeper income received counts as taxable income to the business, just as the wage payments made count as a tax deductible expense to the business. Any JobKeeper payments made to the business via claims based on an eligible business participant are also included as taxable income for the business. There is no GST on this income and it does not count as turnover for GST purposes.

The Treasury’s fact sheet on the JobKeeper extension can be found here.