It is crucial for tax accountants navigating the complexities of international tax law for SME clients to have a good understanding of the exemption for foreign equity distributions – or what used to be known as ‘exempt non-portfolio dividends’.

Equally important however is to understand whether the client’s overseas subsidiary would be a Controlled Foreign Company and how Australia’s CFC’s rules apply.

Sometimes it is the case that a client’s Australian holding company receives a dividend from overseas which could be treated as NANE (non-assessable non-exempt income), but if the actual subsidiary overseas has attributable income under the CFC rules, then the NANE exemption on actual dividends will be of little practical assistance to the client.

This article provides a review of Section 768-5 of the Income Tax Assessment Act 1997 (ITAA 1997) with some practical tips.

We provide an overview of the legislative framework, key considerations, and relevant case law to help you understand the applicability of this section to your clients.

Legislative Framework: Section 768-5 ITAA 1997

Section 768-5 of the ITAA 1997 addresses the exemption of certain dividend income derived from foreign companies. Specifically, this section provides for an exemption from Australian tax when ‘non-portfolio’ dividends are paid to an Australian resident company by a foreign company and certain conditions are met.

Non-Portfolio Dividends

To qualify for the exemption, the entity must satisfy the Participation Test (be a ‘non-portfolio dividend’).

That means that the entity (usually the Australian holding company) must have direct and indirect participation interest in the overseas company of at least 10%.

If dealing with a foreign company, a ‘participation interest’ has a similar meaning to a ‘control interest’ under the CFC rules, except that rights on a winding up cannot be considered when determining whether the Participation Test is passed.

A control interest is essentially an interest in one of the following

- Paid up capital of the foreign company;

- Voting rights concerning distributions of income or capital, changes to the constituent documents of the company or any chances to share capital.

An interest of 10% is considered substantial and active participation in the management and decision-making of the foreign entity, reflecting the intent of the exemption to encourage outbound investment by Australian companies in active foreign businesses.

Practically speaking it is important to obtain from the client confirmation of what types of interest it may have in the overseas company that is paying the dividend.

We suggest that clients be requested to provide a copy of the foreign company’s Constitution or Articles of Association and a copy of relevant share certificates pertaining to the client’s ownership.

You would then be in a better position to determine whether any dividend paid to the Australian holding company qualifies as NANE under Section 768-5.

Active Income Test For Overseas Subsidiaries

As we have said most overseas subsidiaries will in fact be CFCs because they will usually in practice either be 100% owned or Australian controlled, within the meaning of Section 340 ITAA 1997.

For dividends received from CFCs, although the exemption in Section 768-5 may apply, it will be critical to consider how the CFC rules apply.

The Active Income test usually ensures that the income of the CFC is predominantly from ‘active overseas business’ rather than passive revenue streams, such as interest or royalties, or profits arising from transactions with Australian residents.

The Active Asset test has important non-financial measures that are required to be passed but the main financial measure relates to the percentage of gross turnover that is made up of ‘tainted income’.

The gross turnover test requires that less than 5% of the gross turnover comes from tainted turnover. The assumption is that if this threshold is not exceeded, then the CFC should be carrying on an active business and therefore ‘attribution’ should not be required.

Unfortunately the trouble with the CFC rules is that certain business activities which might be thought to generate active business income, might in fact generate ‘tainted income’, which could require ‘attribution’ of income to the Australian client even where there was no tax avoidance purpose.

Successfully passing the Active Income test allows the CFC’s income to be considered active, thereby ensuring that no amounts are attributable to the Australian holding company, hence undoing any potential benefit under Section 768-5.

It is also important practically to know whether you are dealing with a CFC that is resident in a listed or an unlisted country.

That is because for CFCs resident in Listed Countries, the only type of ‘tainted income’ which would be attributable is a limited class of income that is known as ‘eligible designated concession income’ and listed in the regulations to the ITAA 1936.

There are 7 Listed Countries – the USA, Canada, UK, France, Germany, Japan, and New Zealand.

Tainted Income

Tainted income is income from a specific category that is more likely to be associated with tax avoidance strategies. This includes:

- Income from passive investments such as dividends, interest, royalties, rent, and capital gains.

- Tainted sales and tainted services income – that is derived from activities from related parties, such as management fees and sales between the CFC and either an Australian resident related company (in the case of a supply of goods by the CFC) or any other Australian tax resident (in the case of a supply of services by the CFC).

Relevant Case Law

Understanding how the legislation has been interpreted and applied by the courts provides further clarity. Key cases include:

- Esquire Nominees Ltd v. Federal Commissioner of Taxation (1973) 129 CLR 177:

This case highlights the definition and treatment of foreign income and the criteria for classification as exempt income. While predating the current provisions of Section 768-5, it offers foundational principles in understanding foreign income treatment. - FCT v. Unit Construction Co Ltd (1959) 1 WLR 875:

This case delves into the characterization of income and the place of derivation, providing insights into how foreign-sourced income should be treated under Australian tax law. The principles from this case assist in interpreting what constitutes non-portfolio dividends. - Bywater Investments Ltd v. Federal Commissioner of Taxation [2016] HCA 45:

Though primarily concerning the residency of companies, this case underscores the importance of understanding the source and nature of income, critical for determining the applicability of Section 768-5 exemptions.

Practical Implications for Tax Accountants

When advising clients or preparing tax returns involving CFCs, ensure you are checking the following essentials:

- Verify Voting Interests

Ensure that the Australian company holds at least 10% of the voting shares in the foreign company to meet the non-portfolio dividend requirement. - Assess Active Income

Conduct thorough evaluations to confirm that the CFC satisfies the active income test. This might involve detailed analysis of the CFC’s income sources and business activities. Know whether your client’s overseas company is resident of a Listed Country or an Unlisted Country.

- Documentation

Maintain comprehensive documentation to substantiate the CFC’s compliance with the active income test, including financial statements and income breakdowns. - Stay Updated

Regularly review updates to the ITAA 1997 and related regulations, as well as emerging case law, to ensure ongoing compliance and optimal tax planning.

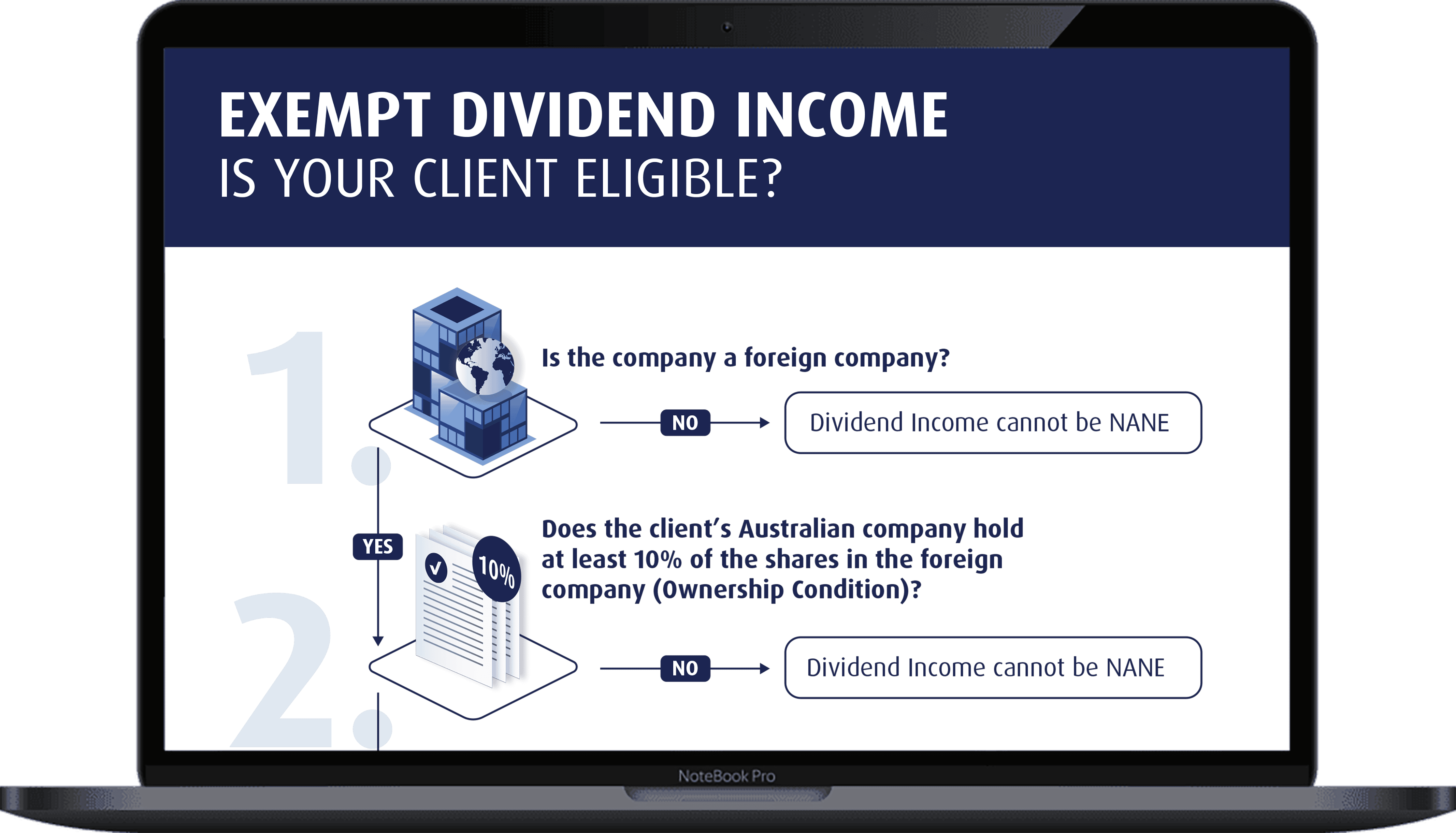

Testing Whether A Client Has Exempt Dividend Income

The steps involved for checking whether your client may have exempt dividend income as a CFC are:

- Does the company meet the definition of a foreign company

- Are the ownership requirements met

- 10% of voting interest

- Substantial management participation

- Is the Active Income Test Passed

- 95% of income is active income

- Adjusted Tainted income is less than 5% of gross turnover

- Meet Documentation and compliance requirements

If all the conditions are met, your client likely has exempt dividend income in their CFC.

FLOWCHART: Exempt Dividend Income: Is Your Client Eligible?

|

To assist you in identifying if your client’s SME is eligible, we have created a flowchart to guide you through the key areas in determining whether dividend income is likely exempt or not. |